Image via Wikipedia

Image via Wikipedia

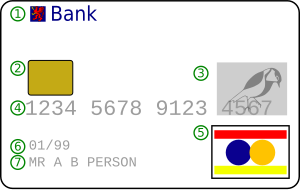

Today we just want to show some of the options that are available and their relative terms. When you are shopping for a credit card, it’s wise to compare fees, charges, interest rates, and benefits. Some credit cards that look like a great deal at first glance may lose their appeal once you read the terms and conditions of use and calculate how the fees could affect your available credit and your payment.

Credit card issuers generally must disclose the important terms of use regardless of whether they require you to complete an application.

- Fees. Many credit card issuers charge membership and/or participation fees. Issuers use a variety of names for these fees, including “annual,” “activation,” “acceptance,” “participation” and “monthly maintenance.” These fees may appear monthly, periodically, or as one-time charges: they can range from $6 to $150. What’s important is they can have an immediate effect on the credit that’s available to you. For example, a card with a $250 credit limit and $150 in fees leaves you with $100 in available credit.

Transaction Fees and Other Charges. Some issuers charge a fee if you use the card to get a cash advance, make a late payment, or if you go beyond your credit limit.- Annual Percentage Rate. The APR is a measure of the cost of credit, expressed as a yearly interest rate. The APR must be disclosed before your account can be activated, and it must appear on your account statements. Your card issuer also must disclose the “periodic rate” – the rate the issuer applies to your outstanding balance to determine the finance charge for each billing period.

- Grace Period. A grace period lets you avoid finance charges if you pay your balance in full by the date it is due. Knowing whether a card gives you a grace period is important if you plan to pay your account in full each month. Without a grace period, the card issuer may impose a finance charge from the date you use your card or from the date each transaction is posted to your account.

- Balance Computation Method for the Finance Charge. If you don’t have a grace period – or if you plan to pay for your purchases over time – find out how the issuer calculates your finance charge. Which method is used to compute your balance can make a big difference in how much of a finance charge you’ll pay – even if the APR and your buying patterns stay pretty much the same.

- Balance Transfer Offers. Many credit card companies offer incentives for transferring your balance – moving your debt from one credit card (Card Issuer A) to another (Card Issuer B). Each offer is different – and the terms can be complicated.

For more information regarding the education needed to gain this type of knowledge in order to prevent yourself from getting into trouble with credit cards, real estate investment strategies that work and other financially related topics please visit http://reinvestorsolutions.com/composer62 and fill out your emauil information so that we get our newsletter of interesting financial topics routinely.

At Nouveau Riche, we are dedicated to education and development of youth, tomorrow's most choice resource....

EDUCATION IS THE ANSWER, WHAT'S THE QUESTION? ®

No comments:

Post a Comment