Image via Wikipedia

Image via Wikipedia

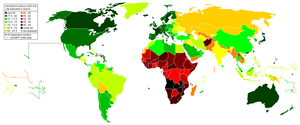

We have witnessed sweeping global changes in the last few years. The world has been transformed on almost every front. Politically, governments and national boundaries have come and gone. Through technology, we routinely communicate with the farthest corners of the

earth in a matter of seconds. Economically, events in far-flung

stock markets across the globe impact every market.

But not only governments and economic markets are affected. These global changes also bring about new financial realities on an individual level. The widespread availability of

credit cards and

automated teller machines makes spending much easier today than in days gone by. And the

proleferation of at-home and on-line banking and investing services allows individuals to act more quickly--and sometimes more rashly--than ever before when making financial decisions.

These changes affect virtually everyone in the

United States--from our youngest workers and students to our eldest

retirees. Yet most

youngpeople in America begin their financial lives unschooled in the basics of saving and investing and unaware of how quickly "easy credit" can add up to big debt. For example, in its 1999 Youth and Money Survey, the American Savings Education Council (

ASEC) found that forty percent of students are likely to buy a pair of jeans (or something similar) they really want even if they do not have the money to pay for it. And 70 percent would pay for it with a "credit card."

And while most adults have high expectations for retirement, many will fail to maintain the lifestyle and standard of living to which they have become accustomed because they failed to plan and save. According to an August 1998 study by the Employee Benefit Research Institute (

EBRI), more than half of American workers--55 percent--have no idea how much they will need to save to save to make their retirement dreams a reality.

Planning for future financial needs--especially for retirement--has also changed. In the past, the burden of planning for the future fell primarily on such external forces as government (through

Social Security and

Medicare) and employers (through

pension plans directed by the employer). Today, however, the responsibility for one's financial future has shifted to the individual.

Over the years I have made incredible amounts of money at my day job in sales of entertainment,

real estate and mortgage origination. And, as most Americans, I lived in the day, a boy with his toys, had the cars, the time shares, the big houses

yada,

yada,

yada. In a recent meeting with my business manager, he produced reports from these various incomes. It was simply amazing to learn that the benefits of my own business and investments in real estate were in in fact saviours of our family's retirement. We can make it happen in the next five years, despite our carelessness in financial planning, as we all can. EDUCATION IS THE ANSWER, WHAT'S THE QUESTION?

Let's get together as an American people and start to change our ways, our education system and our lives.

Image by M.V. Jantzen via Flickr

Image by M.V. Jantzen via Flickr